Again, we have more time to solve the ATM issues but is this time to ‘invest’ or ‘divest’?

History keeps repeating itself, but this crisis is different. Both in terms of its magnitude (unprecedented and complete shutdowns of whole parts of the global economy) and in terms of the huge uncertainty we all live in. The International Monetary Fund (IMF) has recently published its World Economic Outlook Update in which it considerably revised its projections downwards. IATA generally forecasts that air travel may recover more slowly than most parts of the economy and foresees that the global Revenue Passenger Kilometers (RPKs) will only recover to 2019 levels two years after GDP recovers.

The updated World Economic Outlook projects a deeper recession in 2020 and a slower recovery in 2021 than previously expected, with the biggest impact in Europe. This would suggest that GDP will only recover around 2023 which, using IATA’s previous expectations, would imply that air travel in Europe will only rebound around 2025. Not the most optimistic outlook for air travel… On the other hand, this pandemic is still mainly a medical crisis rather than economic, at least at this moment in time. So, if a vaccine becomes available sooner rather than later, the recovery could be much more rapid than currently expected. And recent news that Germany, France, Italy and the Netherlands have already signed an agreement with AstraZeneca, a pharmaceutical group, to ensure the supply to the EU of 300 million doses of a potential coronavirus vaccine gives at least some optimism to the gloomy outlook of key stakeholders.

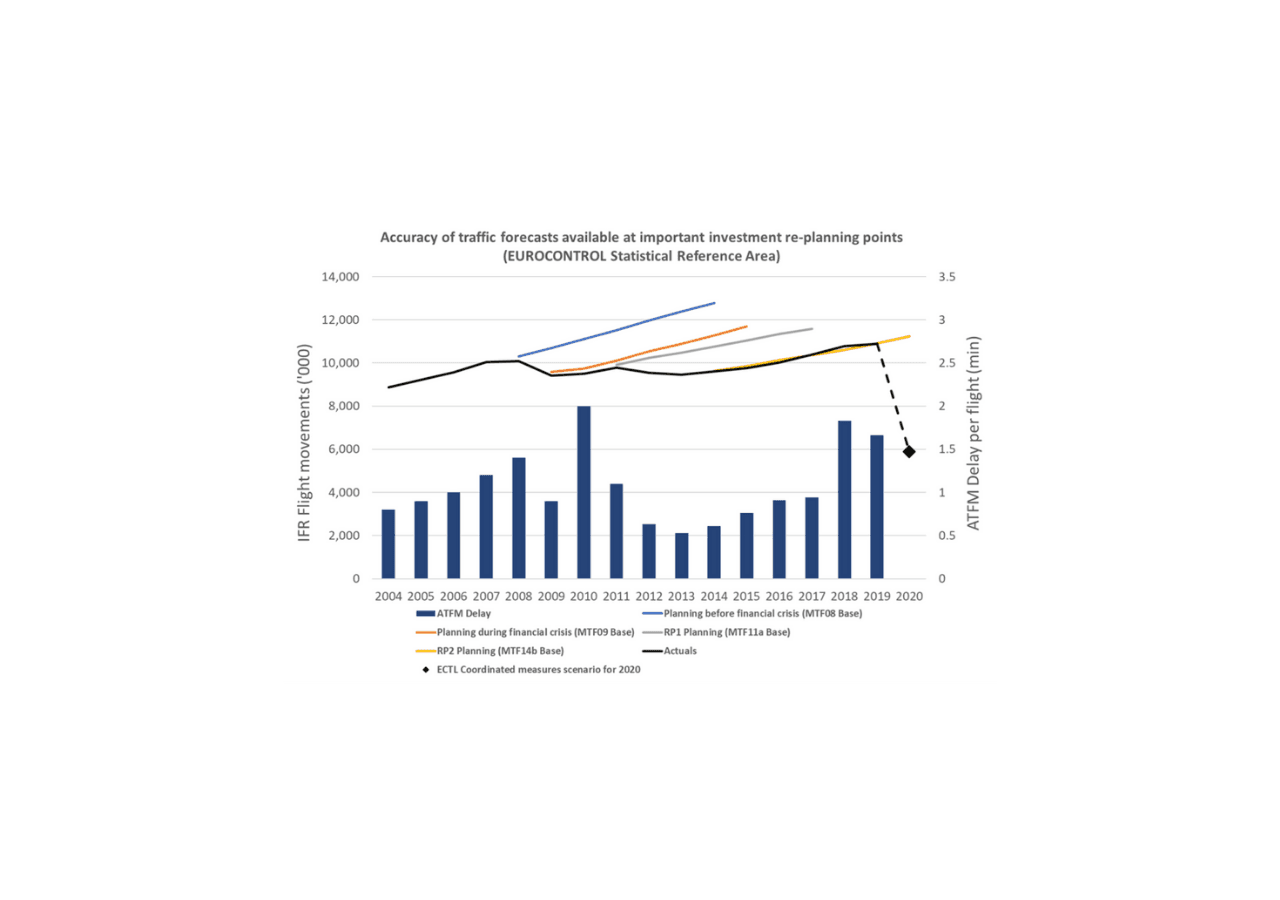

Of course, the current focus is on preserving cash and quite rightly so. Just like other aviation stakeholders, ANSPs are facing huge uncertainties. There are no reliable traffic forecasts, only different scenarios, and European Commission (EC) proposals with measures to ameliorate this unprecedented situation are still only proposals. It is still not clear whether Member States will approve amending the risk sharing mechanism and how, and what funds the ANSPs will have available for their future capital expenditures. So, it is natural that everybody is focusing on managing the short-term and most investments have been frozen, delayed or completely cancelled.

It is already clear that Member States will need to revise their draft RP3 Performance Plans by the middle of 2021. This will include a complete revision of the capex investment programmes, as the current plans are no longer valid and need to be revisited. On the other hand, even though the focus has changed again, the problems we faced in the last few years have not gone away. We need to use the time given to us by these extraordinary circumstances, as well as the significantly reduced resources, in the most efficient way. But how should we do it?

Questions to ask when re-prioritising your Capex programmes.

Additional time is a great opportunity and we need to use it to come out of the crisis stronger, more resilient and better prepared for similar future shocks. My colleagues have recently published valuable blogs on how ANSPs could become more resilient through increasing cost elasticity and how ANSPs could consider strategically developing resilience within their capital infrastructure. In this section, we look at some of the key questions that ANSPs should be considering when reprioritising their investment programmes for the near future. There are also practical implications that need to be considered when investments are being delayed/cancelled.

A structured review of the investment programmes needs to look at reprioritising and potentially streamlining investments to make sure that sufficient resources are available where they are really needed. It could contain the following elements:

Assessment of the situation before the crisis:

- What were the most constraining issues negatively affecting our performance before the crisis?

- Are these issues still valid or have they been completely eliminated by the current situation?

- What will happen if the recovery is more optimistic than the current scenarios?

- Which projects are absolute musts in terms of solving these issues?

Review the programme elements against the following criteria:

- Is the investment aligned with the EAAS vision?

- Is the investment needed for sustainability?

- Is the investment needed for compliance with Regulation?

- Is the investment still needed for performance improvements (ie to support increased safety, capacity, efficiency etc) in light of the current situation?

- What will happen to our performance if the project is delayed/cancelled and the traffic recovers?

- Which other projects will be impacted by delaying/cancelling the project and how?

- Is the technology aligned with the future vision and will it contribute to improving resilience, scalability and sustainability? What other alternatives do we have?

- Is the technology still financially viable?

- Do we need additional investments to improve our resilience against future shocks?

Regardless of the current status of contract:

- Which of the sustainability projects must continue and why?

- Which sustainability projects could be delayed and for how long?

- Where a project is needed to comply with regulation, are the regulations likely to slip given the current crisis? If so, what is the scope for project delay?

- Where a project is needed to provide enhanced performance, can the project now be delayed given the downturn in traffic?

- Can any of the projects be cancelled and new projects re-considered at a later date?

- Can any projects be completed by under-utilised staff rather than using external contractors?

These questions will lead to a potential minimum short-term capex (ie the maximum potential for delay and cancellation). The reality is that this will have to be balanced with other factors such as current contracts already in place and the terms of other loans intended to fund infrastructure. With respect to contracts associated with individual projects:

- What flexibility is there to delay or cancel a project?

- Given the state of the business, is the supplier likely to be flexible to a negotiated delay, re-scope, alternative payment terms etc?

- If contract delay or cancellation is possible, what minimum level of engagement with the supplier is needed to maintain essential programmes and to be able to ramp up again when the project is re-started?

- Are there any projects focussed on achieving future efficiencies, which could be accelerated now whilst traffic levels are lower and changes to operational systems easier to implement?

Conclusion.

This crisis presents an opportunity to emerge stronger, more resilient and better prepared for similar future shocks. Even though resources are scarce and most ANSPs are focusing on their short-term survival, now is the right time to rethink strategies and invest in programmes that will help us to meet future traffic growth while improving the resilience and sustainability of the overall system.

The EAAS has shown the direction and even though some might think that the issues it intended to solve are perhaps no longer so pressing, they have not disappeared. The investments foreseen by the EAAS are not only focused on delivering additional capacity but will also improve resilience and scalability. These are becoming more important than ever. And if we fail again, in a few years’ time we will again wonder how come ATFM delays are starting to increase and complain that we need more time to implement ‘the paradigm shift’.We at Egis have a deep and extensive experience in reviewing capex programmes, either as a part of due diligence projects for approving financing loans or as a direct support to ANSPs. If you are not sure how to reprioritise your capex programmes and which areas are the key to focus on, do not hesitate to get in touch.

--------------------------------------------------------

[1] Performance Review Body: PRB Monitoring Report 2018, October 2019